In order to qualify for tax deferral treatment under Internal Revenue Code § 1031, the taxpayer who is the seller of the relinquished property must also purchase the replacement property. For example, if Alex Smith as an individual sells his relinquished property, Alex Smith as an individual must also buy the replacement property. This sounds simple enough, but oftentimes investors overlook this important detail.

General Rule

To comply with the general rule, the investor should confirm how he owns title to the property to be disposed of (the “relinquished property”) and plan to acquire the new property (the “replacement property”) using the same form of ownership, except for certain limited exceptions described below. For example:

If title to relinquished is held by:

Mary Smith

ABC Partnership Real Estate Corp.

Title to replacement must be held by:

Mary Smith

ABC Partnership Real Estate Corp.

Disregarded Entities

There is one exception to this general rule. Some entities are considered “disregarded entities” for tax purposes. This means that, although the entities do exist in the “real world,” they are completely ignored for tax purposes. For example, if Paula Sanchez sells her investment property that she owns in her name individually, Paula can purchase her replacement property in her name individually or in the name of her revocable trust, since a revocable trust is a disregarded entity. Paula could also acquire the replacement property using a single member limited liability company. As long as

Paula is the sole member (i.e., owner) of the limited liability company; the limited liability company is a disregarded entity and is ignored for tax purposes. In each of these scenarios, for purposes of her 1031 exchange, Paula will be considered the “same taxpayer” as the revocable trust or the single member limited liability company.

If Paula is married and Paula and her husband own the relinquished property, they can buy the replacement property using either a revocable trust or a limited liability company in which they are the only two owners. As long as they are the only two owners of the limited liability company and the property is community property, the limited liability company will be ignored for tax purposes.

Using a single member limited liability company to acquire title gives an investor more flexibility with his lender. Lenders often require that property pledged for a loan be held in an entity that owns only that property, so that the borrower’s other assets do not adversely affect the pledged property. Using a disregarded entity to do that will satisfy the lender while complying with the 1031 tax rules.

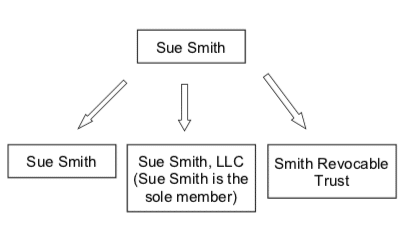

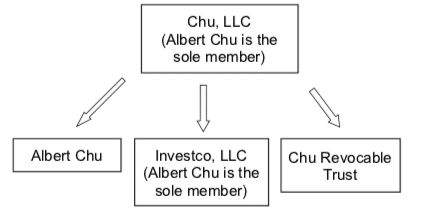

The following chart shows the possibilities for using disregarded entities when acquiring title to property in an exchange:

Changing Title

Individual investors should pay special attention when deleting or adding a spouse to title on either the relinquished or the replacement property. Adding a spouse to title on the replacement property immediately after acquiring it may be treated by the IRS as a gift of a one-half interest in the property (and therefore not satisfying the “held for investment” requirement). Deleting a spouse from title may also have tax consequences. Investors should discuss these issues with their tax advisors prior to selling the relinquished property.

Partnerships

Investors should pay special attention to vesting issues when holding title in a partnership. Section 1031 specifically excludes partnership interests, so it is not possible to defer tax under IRC § 1031 by disposing of and/or acquiring a partnership interest. Moreover, because of the “same taxpayer” rule discussed above, if a partnership sells the relinquished property, the partnership must buy the replacement property. Individual partners cannot separately exchange out of property that is owned by a partnership. Although there are some potential solutions to this problem, they generally require planning and legal work.

For example, sometimes the partnership that owns the relinquished property is dissolved and the property is deeded to the individual partners as tenants-in-common. Some individual partners then do an exchange with their portion of the property and others cash out. There is some risk in this scenario because the IRS often takes the position that the partners have not held the relinquished property for investment purposes, but rather have held it for sale. Investors should seek the advice of a tax attorney when attempting to exchange out of property held in a partnership. In most cases, a limited liability company that has more than one owner is considered a partnership and the same tax issues will apply.

Investors planning to do a 1031 exchange should pay close attention to the vesting on the property they intend to sell in order to ensure that the same taxpayer is the seller of the relinquished property and the purchaser of the replacement property. Advance planning will go a long way towards having a smooth closing and a workable 1031 exchange.